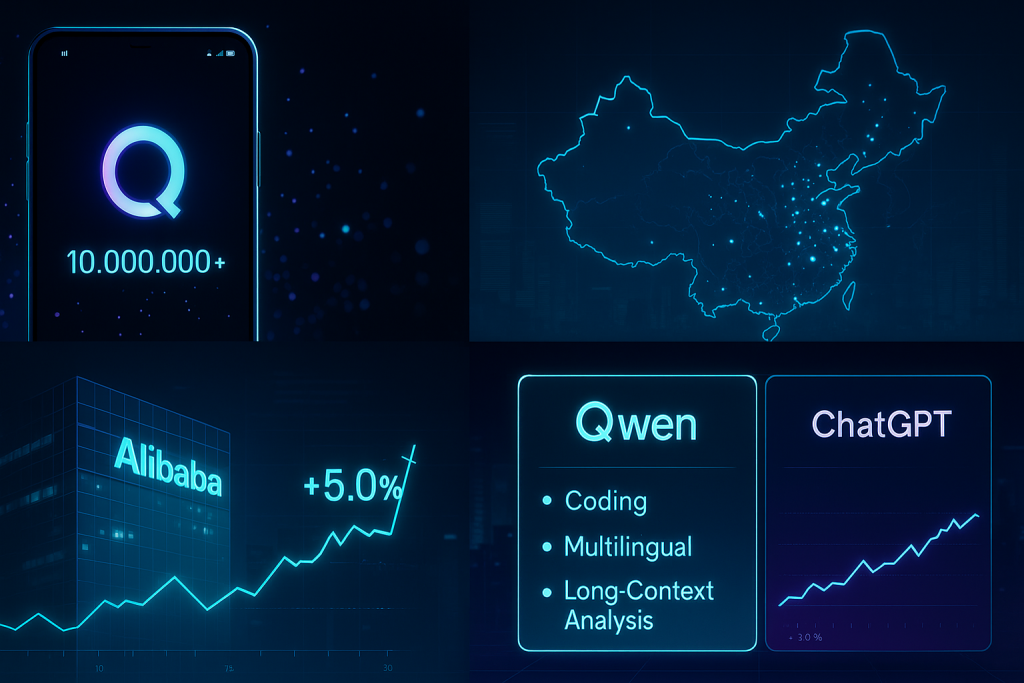

Alibaba just dropped Qwen, an AI chatbot that smashed 10 million downloads in its first week, way faster than ChatGPT’s initial climb.

The app went viral in China right after its relaunch, and Alibaba’s stock jumped 4.67% on the news.

This isn’t just another AI app launch. It signals Beijing’s determination to build a credible challenger to OpenAI while filling a market ChatGPT can’t touch.

For investors watching the AI arms race, Qwen’s momentum matters because it tests whether Chinese tech giants can translate downloads into real revenue.

The technical reality: Where they actually compete

Here’s what you need to know: Qwen 2.5-Max isn’t behind ChatGPT. In fact, recent benchmarks show it’s competitive, and sometimes ahead on specific tasks.

The catch? They win in different lanes.

Qwen dominates multilingual work and coding. It was trained on 20 trillion tokens in multiple languages and handles 128,000-token context windows.

That means it can digest longer documents and analyse complex code better than most competitors.

On LiveCodeBench, Qwen scores 38.7 versus ChatGPT’s 30.2. For math reasoning, Qwen achieved 92.3 on AIME25, a brutal benchmark.

Arena-Hard tests put Qwen at 89.4, topping DeepSeek-V3 and matching GPT-4 performance.

ChatGPT still holds the crown for conversational naturalness and English-language finesse. It’s been trained on more high-quality Western data, and that shows in dialogue flow and nuance.

ChatGPT also benefits from tight integration with enterprise software through Microsoft. For businesses already locked into that ecosystem, ChatGPT remains sticky.

The real competitive edge? Qwen’s open-source architecture lets enterprises customise it.

ChatGPT’s closed API means “take it or leave it.” For companies wanting control and flexibility, Qwen offers freedom that ChatGPT doesn’t.

The market story: Geography, monetisation & stock upside

Here’s the financial angle that moves stocks: ChatGPT isn’t available in mainland China. Google’s Gemini isn’t either.

Qwen owns a vacuum worth 1.3 billion Chinese users. That’s not a small market to capture.

Alibaba’s integration strategy is the real play. Qwen will embed into Taobao (for AI shopping), Alipay (for payment recommendations), and coming attractions include maps, food delivery, and travel bookings.

Think about that: an AI assistant that lives inside your shopping and payment apps. The ecosystem lock-in potential is massive for user retention and engagement.

Monetization? It’s free now; the team has no immediate plans to charge. But once daily active users climb, Alibaba can layer in premium features and enterprise tools.

No single AI app in China has hit 100 million daily active users yet, so the upside runway is real.

The stock market’s reaction: Alibaba up 5% on Qwen news, signals investor confidence in this strategy. Wall Street is pricing in the possibility that Qwen drives consumer revenue growth and justifies higher valuations for Alibaba.

The key metric to watch: user retention rates and monthly active user growth. Downloads are noise. Stickiness drives valuation.

The post Explainer: how Alibaba’s Qwen AI app stacks up against ChatGPT appeared first on Invezz